Hunk Times - Case Study - WeChat Bank, X-- Net Bank

2022 Aug

X--Net Bank is a high-tech Internet bank (Neobank) that conducts its primary business through its website and mobile app. It makes extensive use of technologies such as cloud computing, big data analysis, and artificial intelligence to reduce manpower costs and provide efficiency. It provides a safer, more convenient, and more efficient financial service to its SME customers.

For this WeChat Bank project, X-- Net Bank has embedded its banking portal within WeChat, a popular social networking application in China and the global Chinese community. WeChat Bank allows users to access X-- Net Bank's primary services inside the WeChat cellphone app. Its main functions include personal loans, small business loans, anti-fraud, authorization of several credit facilities, online payments, utility payment services, etc.

Hunk Times - Case Study - WeChat Bank, X-- Net Bank

2022 Aug

X--Net Bank is a high-tech Internet bank (Neobank) that conducts its primary business through its website and mobile app. It makes extensive use of technologies such as cloud computing, big data analysis, and artificial intelligence to reduce manpower costs and provide efficiency. It provides a safer, more convenient, and more efficient financial service to its SME customers.

For this WeChat Bank project, X-- Net Bank has embedded its banking portal within WeChat, a popular social networking application in China and the global Chinese community. WeChat Bank allows users to access X-- Net Bank's primary services inside the WeChat cellphone app. Its main functions include personal loans, small business loans, anti-fraud, authorization of several credit facilities, online payments, utility payment services, etc.

Functions

Customers can access X-Net Bank by opening their mobile phone, opening the WeChat App, searching for the WeChat Public ID "X-Net Bank", following the public number, or opening the X-Net Bank app to access the X-Net Bank WeChat Bank.

Search "X-Net Bank" inside of WeChat:

Enter "X-Net Bank" WeChat small App or WeChat Public ID:

Technology Architecture

(In Archimate)

Business Value

WeChat is a top-rated social media software, with over 1.3 Billion active users by the end of 2022. So by opening a banking services portal on WeChat, it makes it easier for bank users to access the bank's various services and to share the customer experience of banking services to diverse social media communities, to friends, and to join, thus making it easier for the bank to bring in new customers.

Through WeChat Banking, X--Net Bank can serve its customers more conveniently and reach a more extensive customer base. By leveraging digital identification solutions, and social media, WeChat Bank can provide clients with personalized banking services that accurately meet their needs. Customers can benefit from faster onboarding processes and more customized product and service offerings tailored to their needs.

Project Information

Service Subscription: The customer is an Internet Bank (Neobank), over 30 Million subscriber.

Hunk Times Team Members:

Yu Y-- S--, Backend Dev

Chen X-- H--, QA

Ma L--, Frontend Dev,

Ma F--, Frontend Dev

Wang X--, Frontend Dev

Chen F--, Frontend Dev

Liu F--, Frontend Dev

Tang Q--, QA

Tuo H-- L--, QA

Hunk Times Service Scope:

"WeChat front-end and back-end product innovation platform API and channel API (front-end) for "G-- P-- Loan", "G-- B-- Loan" and "G-- T-- Loan

1. Product instance creation

2. Deployment code creation

3. Product instance framework configuration (service application selection)

4. Service application content configuration

5. Preview and release

6. Consistency in product form (online & offline)

7. Data migration

8. WeChat banking back-end productization project build and development implementation of functions.

Design and development implementation of the core productization component functions for the corresponding functions of WeChat Banking back-end.

9. WeChat Bank WeChat front-end all interaction logic and interface style presentation.

WeChat Bank internal other systems (public service platform, credit core, user centre, unified payment, etc.) interfacing development.

10. G-- P-- Loan project development, docking with other partner banks of ICBC and Postbank.

11. H5 encrypted keyboard front-end development, using face recognition, ID card OCR and other technologies for live detection.

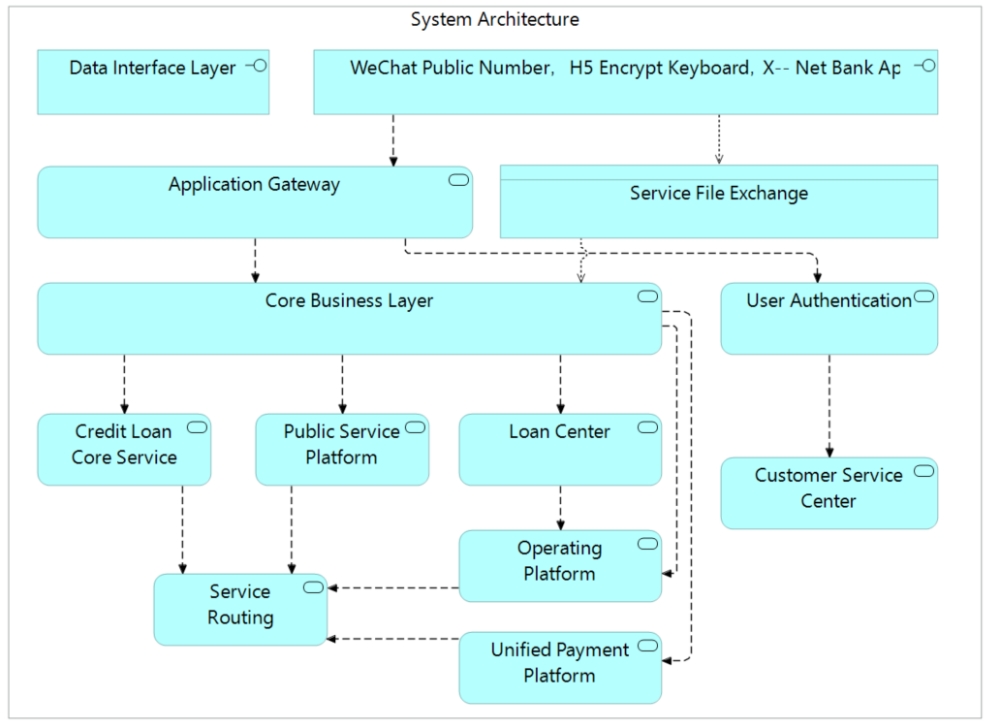

Application Architecture

(In Archimate)

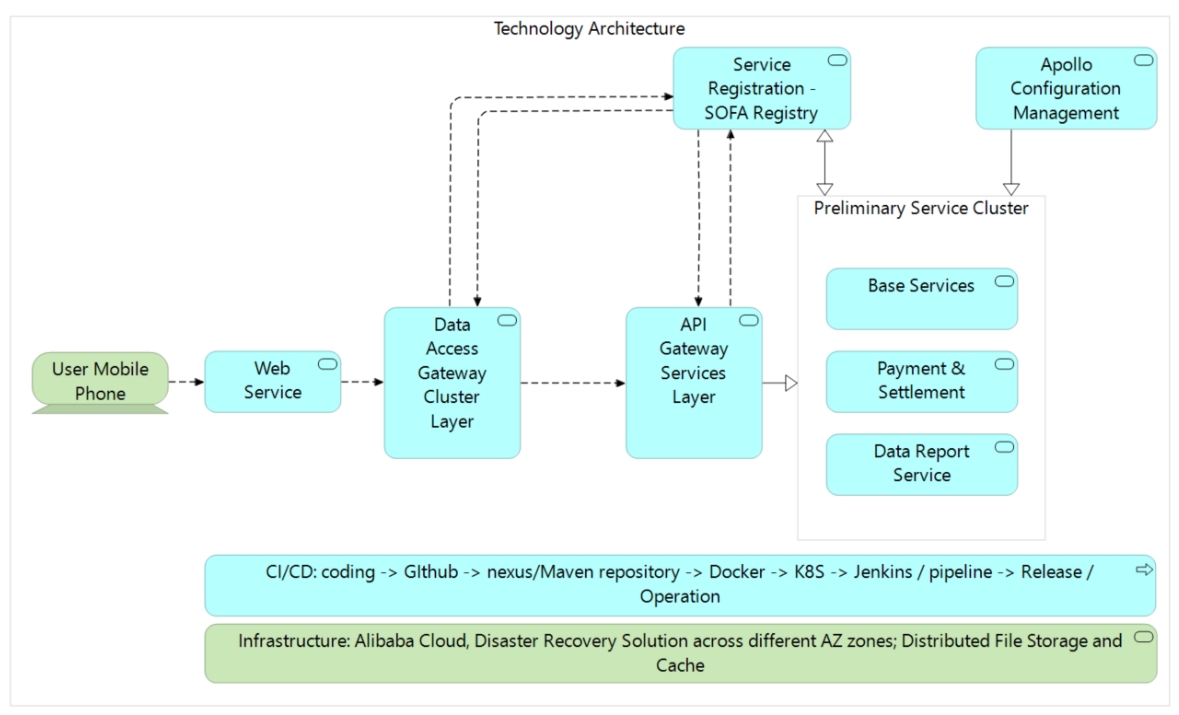

Technology Architecture

(In Archimate)

Functions

Customers can access X-Net Bank by opening their mobile phone, opening the WeChat App, searching for the WeChat Public ID "X-Net Bank", following the public number, or opening the X-Net Bank app to access the X-Net Bank WeChat Bank.

Search "X-Net Bank" inside of WeChat:

Enter "X-Net Bank" WeChat small App or WeChat Public ID:

Hunk Times - Case Study - WeChat Bank, X-- Net Bank

2022 Aug

X--Net Bank is a high-tech Internet bank (Neobank) that conducts its primary business through its website and mobile app. It makes extensive use of technologies such as cloud computing, big data analysis, and artificial intelligence to reduce manpower costs and provide efficiency. It provides a safer, more convenient, and more efficient financial service to its SME customers.

For this WeChat Bank project, X-- Net Bank has embedded its banking portal within WeChat, a popular social networking application in China and the global Chinese community. WeChat Bank allows users to access X-- Net Bank's primary services inside the WeChat cellphone app. Its main functions include personal loans, small business loans, anti-fraud, authorization of several credit facilities, online payments, utility payment services, etc.

Functions

Customers can access X-Net Bank by opening their mobile phone, opening the WeChat App, searching for the WeChat Public ID "X-Net Bank", following the public number, or opening the X-Net Bank app to access the X-Net Bank WeChat Bank.

Search "X-Net Bank" inside of WeChat:

Enter "X-Net Bank" WeChat small App or WeChat Public ID:

Technology Architecture

(In Archimate)

Business Value

WeChat is a top-rated social media software, with over 1.3 Billion active users by the end of 2022. So by opening a banking services portal on WeChat, it makes it easier for bank users to access the bank's various services and to share the customer experience of banking services to diverse social media communities, to friends, and to join, thus making it easier for the bank to bring in new customers.

Through WeChat Banking, X--Net Bank can serve its customers more conveniently and reach a more extensive customer base. By leveraging digital identification solutions, and social media, WeChat Bank can provide clients with personalized banking services that accurately meet their needs. Customers can benefit from faster onboarding processes and more customized product and service offerings tailored to their needs.

Project Information

Service Subscription: The customer is an Internet Bank (Neobank), over 30 Million subscriber.

Hunk Times Team Members:

Yu Y-- S--, Backend Dev

Chen X-- H--, QA

Ma L--, Frontend Dev,

Ma F--, Frontend Dev

Wang X--, Frontend Dev

Chen F--, Frontend Dev

Liu F--, Frontend Dev

Tang Q--, QA

Tuo H-- L--, QA

Hunk Times Service Scope:

"WeChat front-end and back-end product innovation platform API and channel API (front-end) for "G-- P-- Loan", "G-- B-- Loan" and "G-- T-- Loan

1. Product instance creation

2. Deployment code creation

3. Product instance framework configuration (service application selection)

4. Service application content configuration

5. Preview and release

6. Consistency in product form (online & offline)

7. Data migration

8. WeChat banking back-end productization project build and development implementation of functions.

Design and development implementation of the core productization component functions for the corresponding functions of WeChat Banking back-end.

9. WeChat Bank WeChat front-end all interaction logic and interface style presentation.

WeChat Bank internal other systems (public service platform, credit core, user centre, unified payment, etc.) interfacing development.

10. G-- P-- Loan project development, docking with other partner banks of ICBC and Postbank.

11. H5 encrypted keyboard front-end development, using face recognition, ID card OCR and other technologies for live detection.

Application Architecture

(In Archimate)

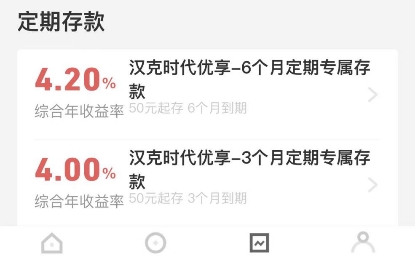

Personal Loan, Business Loan, Real Estate Loan.

Loan Application: The customer initiates forensics through WeChat Bank by providing loan trial calculations, limit checks, and anti-fraud risk control tests. The borrowing application is then submitted.

Information filling, credit application.

After filling in the basic customer information and invoking anti-fraud, submit the credit application.

Business Value